[ad_1]

janiecbros/E+ via Getty Images

Shares of Tilray (TLRY) soared 13.6% on the first day of trading this week after the cannabis company astonished the market with a surprise profit that was largely driven by factors unrelated to business performance. The firm continues to face an uncertain future and revenue challenges persist. Since the risk profile is skewed to the downside, I do not recommend to jump on the bandwagon here!

Second-quarter showed revenue growth, but Tilray still missed predictions

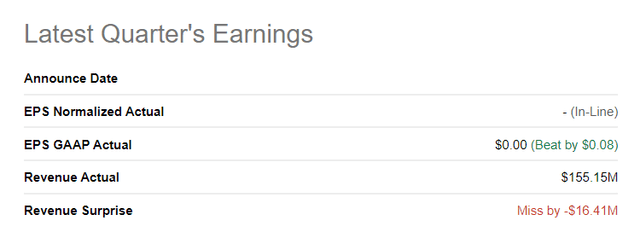

On the surface, the second-quarter for Tilray was a good one. The Canada-based pharmaceutical and cannabis company reported net revenues of $155.2M in the second-quarter. The revenue number missed predictions by $16.4M. The cannabis firm submitted Q2’22 breakeven EPS which was better than the market prediction.

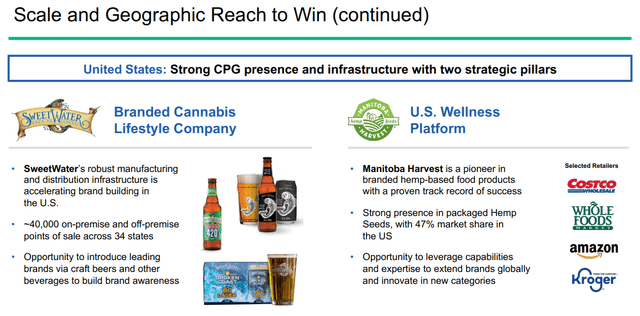

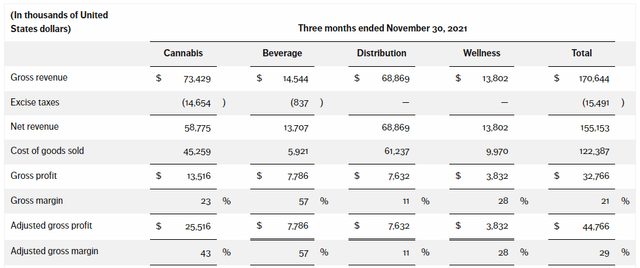

Tilray’s revenues increased 20% year over year to $155.2M in the second-quarter and were driven by 7% year-over-year growth in cannabis product sales and significant revenue contributions from the firm’s new businesses. While cannabis product sales still generated 38% of net revenues in the second-quarter, the firm’s revenue mix is changing, which is chiefly the result of two businesses Tilray acquired; 1. SweetWater, which is a U.S. based craft beer company and 2. Hemp food maker Manitoba Harvest. Tilray, due to competitive and pricing pressures in the Canadian cannabis market is seeking to diversify its business and reposition itself as a global consumer packaged goods company with a more international profile. The change in business positioning is also meant to cushion the impact of delayed recreational cannabis legalization in the U.S.

The revenue shares of Tilray’s beverage and wellness businesses are growing rapidly, in part because they are new acquisitions and the commercial performance of these segments is starting to be fully reflected in Tilray’s financials. Beverage and wellness revenues generated around $14M in revenues each in the second-quarter which calculates to a 9% revenue share. The share of cannabis sales in Tilray’s portfolio is likely going to further decrease in the future.

Despite a 20% increase in Tilray’s top line, the firm’s gross profit dropped 7% year over year to $32.8M. The beverage segment continues to have the highest gross margin (57%), followed by Wellness (28%), Cannabis (23%) and Distribution (11%). Because Tilray’s new beverage and wellness segments have higher gross margins than Cannabis, the acquisitions are having a positive margin impact on the combined business.

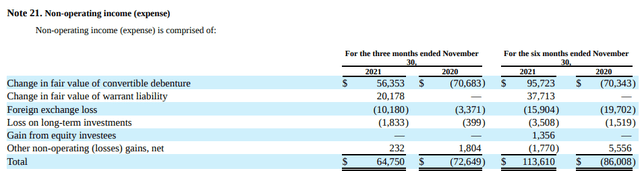

Tilray had lower gross profits and higher operating expenses compared to last year, but the firm’s profits swung from a $89.2M loss in Q2’21 to a $5.8M profit in Q2’22. The profit surge was not attributable to a stronger commercial performance, like I just explained, but to a $64.8M gain, resulting chiefly from fair value changes related to the firm’s liabilities. These gains are included in non-operating income and boosted Tilray’s Q2’22 significantly.

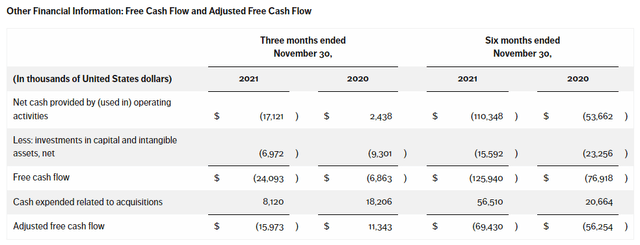

Free cash flow

Tilray’s free cash flow remains challenged and the firm once again failed to report positive free cash flow for the last quarter. Tilray’s Q2’22 free cash flow was $(24.1)M and free cash flow for the first six months of the year doesn’t look much better: it was $(125.9)M.

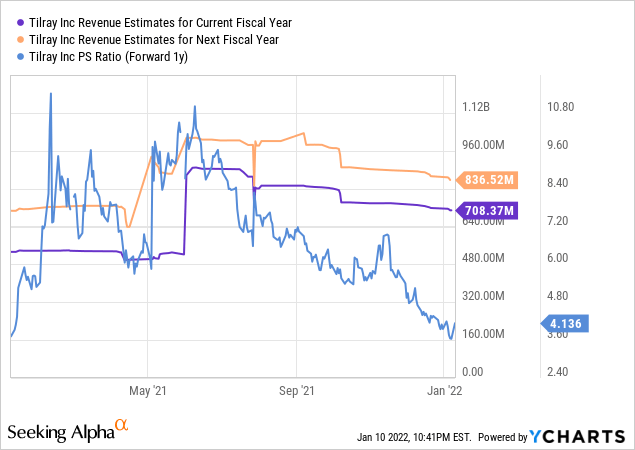

The valuation is just too high

The expectation is for Tilray to have revenues of $836.5M next year and the consumer packaged goods company will once again not be profitable. It is also highly unlikely that Tilray will generate positive free cash flow. Based off of sales predictions, shares of Tilray still have an inexplicably large P-S ratio of 4.1 X…

Risks with Tilray

Tilray faces revenue pressures in the cannabis market and the company was forced to cut prices in 2021 due to persistent product oversupply. Tilray is the cannabis market leader in Canada but competition is increasing and prices are dropping. For that reason, cannabis sales face continual headwinds in 2022 and the share of Tilray’s cannabis revenues is most likely going to shrink going forward. Tilray may also face headwinds with respect to the legalization of Cannabis in the U.S. which is not making too much progress. Also a problem, Tilray is deeply deficient regarding free cash flow.

Final thoughts

Shares of Tilray are in a longer-term downtrend and although the business swung to a profit in the last quarter, significant uncertainty remains about the future direction of the business. A huge obstacle to price appreciation for shares of Tilray is that the company has negative free cash flow and the valuation, relative to actual commercial performance, is high. For those reasons, it may be best to avoid Tilray altogether!

Source link